VAT reduction on 01 July 2020: Users of WinSped must take this into account

The economic stimulus package adopted by the German Federal Government on 3 June 2020 includes, among other things, a reduction in value added tax as of 1 July 2020. the reduced tax rates of 16% and 5% apply until 31 December 2020.

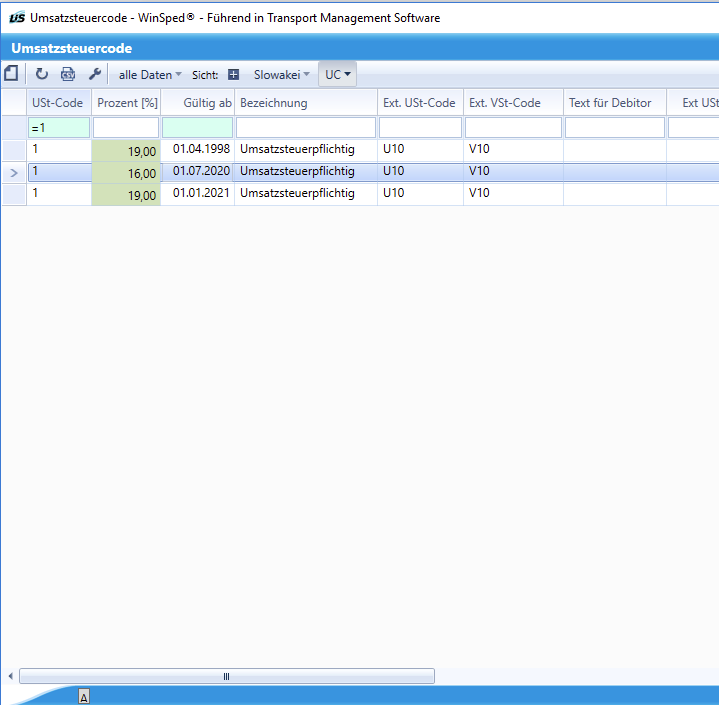

As a user of WinSped the change of the VAT rates is uncomplicated if you observe the following: For the period of the VAT reduction (01.07. to 31.12.2020) small changes must be made in your system. Prepare WinSped already now by entering the same VAT codes with new validity dates:

- 16% from 01.07.2020 and

- 19% from 01.01.2021

This ensures that the valuation determines the sales tax code percentage value correctly.

The entry of reduced tax rates has different effects depending on whether you use WinSped with or without a multi VAT code.

WinSped without Multi-UC (Standard)

- On documents with settlements from June and July, you automatically receive a document for June and a document for July.

- Special invoices must be created individually for June and July. Although the system does not prevent settlements from being entered for June and July (for example, June 15 to July 15, 2020), it displays the error and no print can be triggered. Depending on the options set, either the old or the new UC then appears. Therefore, you must avoid overlapping entries.

If you have nevertheless missed to enter the new tax rates until 30.06.2020, you must proceed as follows:

- If a document for July with 19% has already been created:

- a partial/cancellation of the settlements from the service date 01.07. must be made

- the cancellation itself still accounts for 19% of the print

- revalue

- If evaluations are already available:

- the assessment must be withdrawn

- revalue

- If a special invoice has already been entered:

- Documents with monthly settlement can be printed directly

- Mixed documents (June + July) are not allowed and must be broken down manually

WinSped with Multi-UC

- On documents with statements from June and July mixed, the UC appears twice with the respective % rate

- On special invoices with settlements in June and July, the UC appears twice with the respective % rate

If you have nevertheless missed to enter the new tax rates until 30.06.2020, you must proceed as follows:

- If a document for July with 19% has already been created:

- A partial/cancellation of the settlements from the service date 01.07. must be made

- the cancellation itself still accounts for 19% of the print

- revalue

- If evaluations are already available:

- the assessment must be withdrawn

- revalue

- If a special billing document (VB) has already been entered in program SF, the special billing items must be saved again from July 01.

- If a special billing document has already been entered in the SI program, the print automatically recognizes the change and you do not need to do anything else.